How will tariffs impact American communities?

Lost wages, unemployment scenarios, and most-impacted ZIP codes for the biggest US cities.

The April 2025 US tariff declarations will lead to $5.32 - $14.9B in lost wages and as many as 198,000 lost jobs in the next 12 months across the most populous cities in the United States.

The unemployment rate in these cities will rise by 34% - 95% in the coming year.

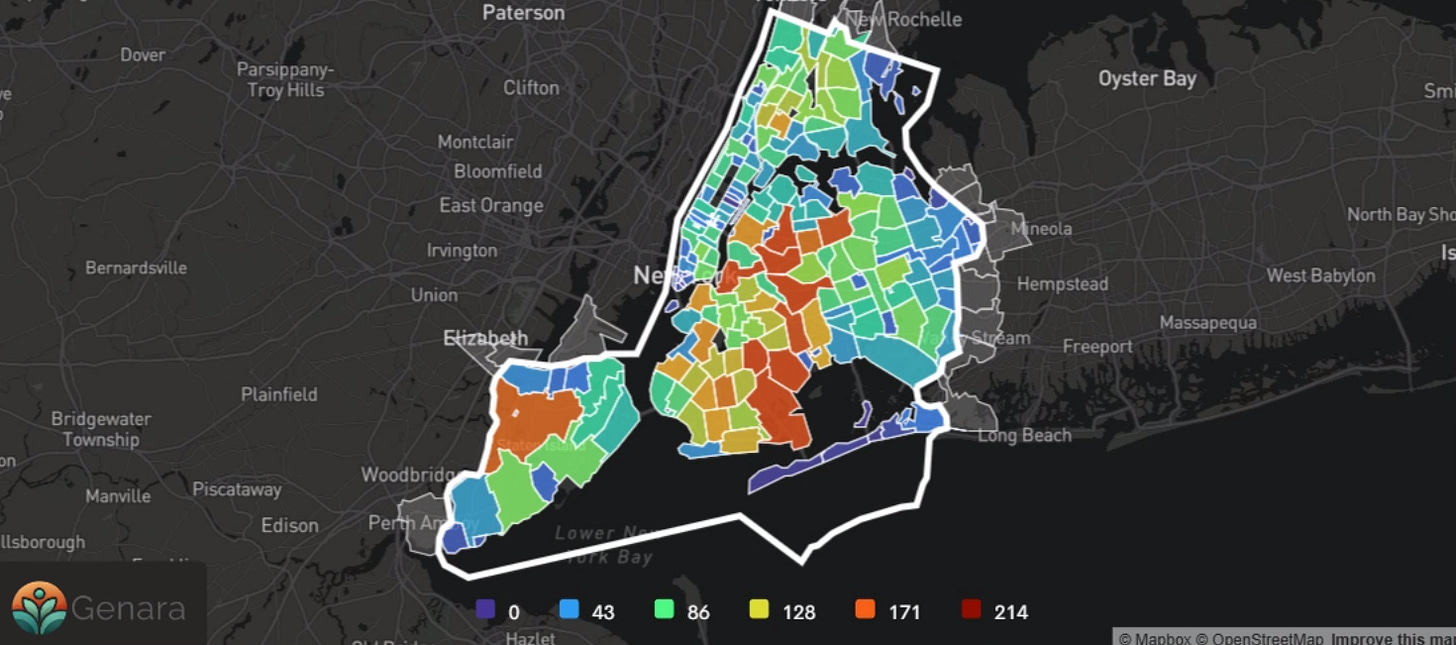

New York City residents will suffer $1.1B - $3.3B in lost wages

Charlotte will see unemployment claims rise by 105% - 293%

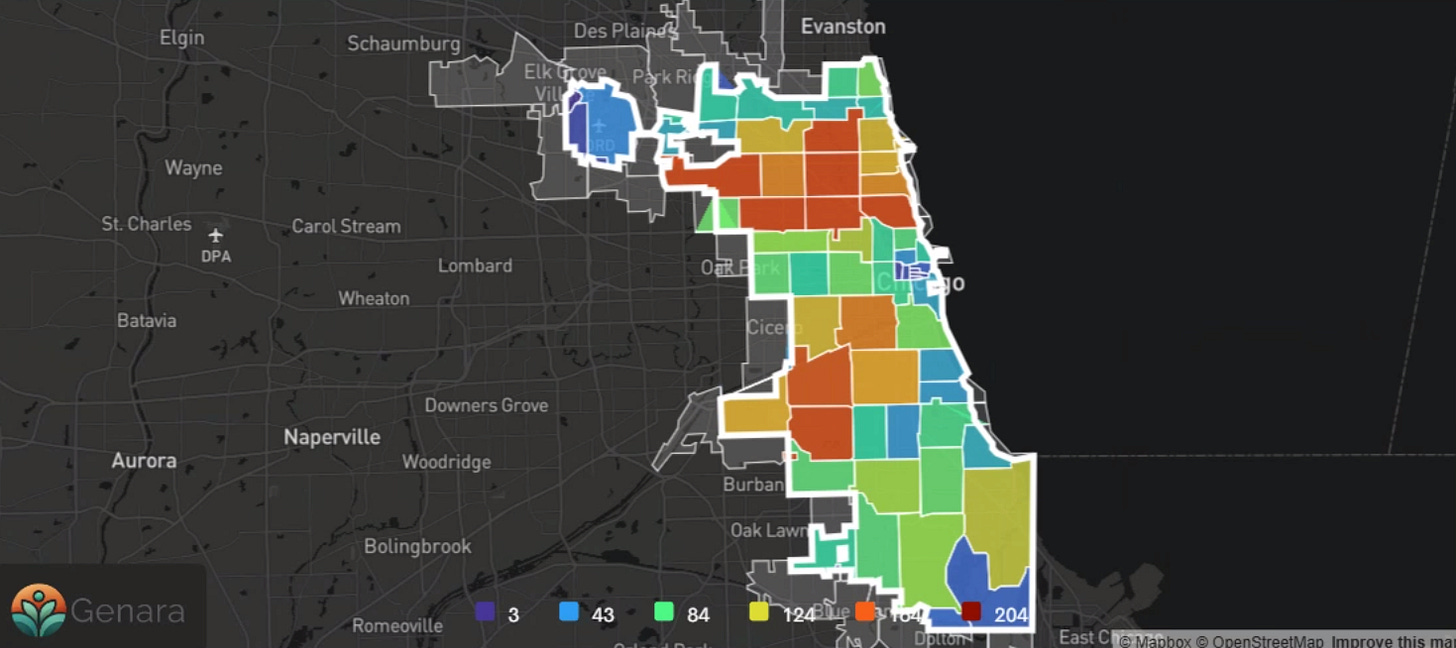

Chicago will lose between 5,000 - 14,000 jobs in the next year

Our initial analysis is focused on the top cities because they are the geographies where the losses can be most easily understood. In rural and exurban areas – where manufacturing, agriculture, and other heavily-impacted industries largely operate – the short-term impacts are likely to be even more severe.

Tariffs will have a significant economic impact on New York City, with estimated job losses in the next 12 months at least 15,000 and potentially as high as 43,000. The represents $1.1 billion to $3.3 billion in lost wages. This has the potential to double the amount of people seeking unemployment. The hardest-hit industries include Retail Trade, Health Care, and Service providers. ZIP codes 10171, 10154, and 10065, feel the brunt of th effects in the baseline scenario, while the outer areas of Brooklyn and Queens face the most job losses in the worst case scenario .

Los Angeles is the third most impacted city, with estimated job losses in the next 12 months at least 6,100 and potentially as high as 17,000. This represents $408 million to $1.14 billion in lost wages. The largest impacted industry in LA is manufacturing, representing 25% of the total lost jobs. ZIP codes 90057, 90211, and 91401, largely in the north and east parts of the city. These additional costs ripple through the supply chain, raising prices for consumers and squeezing small business margins in already high-cost districts.

Chicago is the fourth most impacted city, largely because of its manufacturing sector, with estimated job losses in the next 12 months at least 5,200 and potentially as high as 14,000. This represents $369 million to $1 billion in lost wages. The largest impacted industry in Chicago is manufacturing, representing 25% of the total lost jobs. ZIP codes 60618, 60647, and 60657 are the most impacted in the Chicago area.

How We Did It: Methods and Multipliers

We estimated the employment impacts of a hypothetical 10% across-the-board tariff using a multi-channel economic model informed by academic research, government data, and sector-specific multipliers. The analysis incorporates direct impacts—like import protection benefits and input cost penalties—alongside indirect and retaliatory effects, such as demand shocks from higher prices and export slowdowns due to foreign tariffs. Industries were classified by NAICS codes and analyzed based on their exposure to global trade, supply chain dependencies, and consumer-driven dynamics. We then modeled two scenarios: a conservative case assuming moderate substitution and minimal retaliation, and an aggressive case assuming full passthrough of costs and proportionate trade retaliation.

Employment impacts were calculated by applying industry-specific job loss multipliers—expressed as percent job changes per 10% tariff—and adjusting them based on regional economic characteristics such as metro size and industrial composition. For example, manufacturing-heavy regions saw amplified losses (+20%) while diversified service economies experienced mitigated impacts (–15%). City-level estimates were derived by summing employment deltas across all industries. Data inputs included BEA input-output tables, EPI multipliers, Federal Reserve tariff studies, and academic elasticity estimates. While robust in design, our model reflects short-term (12-month) impacts and does not incorporate longer-term structural adjustments.

To explore this in detail, view the “Methodology” tab in the Tariff Impact Explorer.